Benefits of Buying Used Cars: THE KEY TO MAKING the right choice is finding the vehicle that best fits your priorities, such as price, fuel economy, safety, comfort, and reliability. We spread out a deliberate way to deal with surveying your requirements and match them to a manageable number of hopeful vehicles.

Buying Tips and Advice – Benefits of Buying Used Cars

Our recommendations are based on hands-on testing, the largest pool of reliability data available anywhere, and our car experts’ accumulated knowledge. This chapter will guide you to the best models and steer you away from those that don’t measure up. At the same time, we’ll show you where to find the info to make a smart decision.

Do You Need Car Insurance (Auto Insurance ) To Drive?

Benefits of Buying Used Cars instead of NEW

In the year 2021, a record number of new cars were sold across the United States, coming in at 17.6 million. Now the same year, 2021, how many used cars do you think were sold in the United States? The number is going to come in higher or lower than new cars.

Well, if you guessed lower, you’d be wrong. The number was not only higher. It was more than twice as high, coming in at 38.5 million used cars sold in the United States in 2021. WHY?

The Used-Car Sweet Spot

Two- and 3-year-old used vehicles are often the best values when shopping for a car. Their cost is lower than a practically identical new car’s, and proceeding costs, for example, impact protection, what’s more, charges are lower. Furthermore, 2-or 3-year-old vehicle has effectively taken their greatest devaluation hit.

Purchasing utilized is an approach to get a more pleasant vehicle than you’d be ready to manage the cost of new one. But buying a used vehicle means being able to find the right balance of value and risk. The following section presents some issues to consider.

Reliability.

One thing that has made utilized vehicles all the more engaging is their enhanced, unwavering quality. In an analysis of Consumer Reports’ annual subscriber surveys over the past few years, we found that 5-year-old vehicles had one-third fewer problems than the 5-year-old vehicles we looked at in 2007.

Rust and fumes framework issues are never again normal, and real motor and transmission issues have likewise diminished, making late-demonstrate utilized vehicles far to a lesser extent a risk.

When properly maintained, today’s vehicles should easily surpass 100,000 miles without major work, and many could reach 200,000 miles.

Best tips to Hire a Car Accident Lawyer Near You

Warranties and repairs.

In spite of the fact that utilized vehicles are more solid than ever, upkeep and fixed costs are, as yet, vital contemplations. The first two or three years of a car’s life, while a comprehensive warranty covers it, generally see a few problems. But a used car is usually out of warranty. You can expect not just more issues as the years and miles heap up yet, in addition, all the more expensive ones.

This means owners will have to pay for repairs and for parts that get worn, such as tires, brakes, and batteries. Be that as it may, regardless of whether you supplanted each one of those things the minute you purchased a utilized vehicle, you’d even now spare more than purchasing another vehicle. There is always the risk that you’ll buy a lemon. Be that as it may, regardless of whether you supplanted each one of those things the minute you purchased a utilized vehicle,

you’d even now spare more than purchasing another vehicle. By using the tips in Chapter 3 and having the vehicle thoroughly inspected by a qualified mechanic, you can protect yourself against nasty surprises.

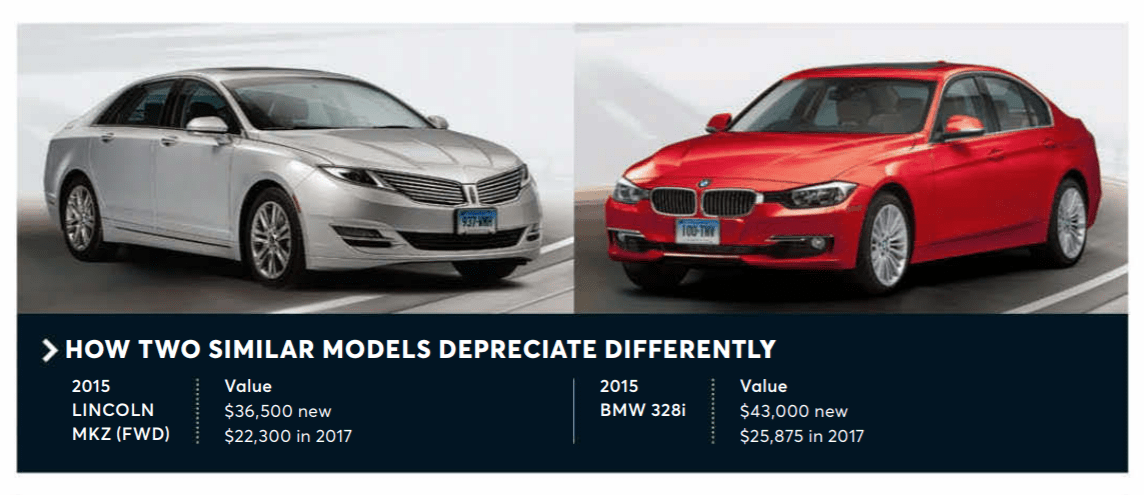

Depreciation.

Rapid depreciation is one noteworthy impediment to purchasing another vehicle. Models usually lose about 46 percent of their value during the first three years, compared with 24 percent over the next three, but this can vary. The BMW 328i, for example, holds its value relatively well (about 43 percent depreciation over the first three years), and the Lincoln MKZ has depreciated more rapidly (about 50 percent).

Several factors determine deterioration, including the model’s notoriety, seen quality, supply, and whether or on the other hand, not it’s the present age. The average depreciation on a $35,309 car means that after three years, it’s worth only $17,964—a huge hit in the vehicle’s residual value.

Interest rates.

Historically, loans for new cars have a lower interest rate than ones for used cars, but that isn’t always the case. In October 2015, the national average for a 48-month new-car loan was about 4.25 percent, according to Bankrate.com’s National Index; a 48-month used-car loan was about 5.32 percent.

At the point when rates are inside 1 rate point of one another, the extra intrigue you would pay on a normal advance includes just about $7 to $15 to the month-to-month credit installment.

Insurance.

You’ll usually pay a bit less to insure a used vehicle than a new version of the same model.

Safety.

When you buy a used car, you might not get the latest safety features. Features such as electronic stability control, head-protecting curtain airbags, and collision-avoidance systems are difficult to find on older vehicles. But systems such as antilock brakes, traction control, and side airbags are quite commonplace.

Editors’ Recommendations:

Common Car Problems That You Can Be Fixed In A Day

Hire A Car Accident Lawyer Near You – Accident Lawyer Fees

How Much Will It Cost?

You may as well belong to a show that grabbed your attention or highlights that will make your driving more pleasurable. But the first step in buying a car should be to estimate what price range you can afford. To do this, you need two snippets of information:

Down payment.

How much money can you pay upfront in cash, with a trade-in, or both?

Monthly payment.

If you plan to borrow money, what is the maximum monthly payment you can afford?

It used to be easy to find an auto loan that required a low down payment or none at all. But those deals are more difficult to find. Now, many buyers have to put down more money, and no-money-down loans are rare. To minimize your overall cost for the loan, put down as much as you can afford— preferably at least 20 percent.

A higher initial installment diminishes the sum of cash you have to obtain, which brings down your regularly scheduled installments and decreases the measure of, generally speaking, interest you’ll pay. Prices are the main benefits of buying used cars.

The down payment doesn’t need to be all money. In the event that you, as of now, have a vehicle, any exchange remittance the merchant gives you tends to be credited toward your initial installment. For a variety of reasons, a dealer might offer you very little for your trade-in, and you’d be better off selling it privately or to another dealer.

For instance, if your present car is old, in bad shape, or not in demand where you live, the dealer might plan to sell it on the wholesale market. If that’s the case, then expect a bottom-dollar offer because the car will change hands at least twice before it gets to the next retail owner. Chapter 5 (see page 72) tells you how to estimate the value of your present car and how to get the best price for it. However, you choose to sell it.

How much can you afford?

To get a ballpark figure for the monthly payment, a common rule of thumb is that your total monthly debt payments should be no more than 36 percent of your month-to-month net salary. Of course, less is always better, but following this rule, you can use the following steps to determine how much you can afford:

■ Calculate 36 percent of your monthly gross income.

■ Separate and aggregate the majority of your regularly scheduled installments, including your home loan or lease, Mastercard bills, also other portion credits.

■ Subtract the total of your monthly payments from the 36 percent figure.

For example, if you’re pretax yearly pay is $75,000, add-up to obligation installments ought not to surpass $27,000 every year. If your existing debt payments equal, say, $20,000 per year, you shouldn’t exceed $7,000 annually or $583 per month for car payments. What you may “qualify for” and can “afford” are different things.

When you make a realistic assessment of all your monthly financial obligations and consider that insurance, gasoline, and other running costs must be met, you may find you have far less available to service a car loan than you thought.

By knowing your down payment and monthly payment, along with a typical interest rate and the number of years you’re willing to make car payments (the term of the loan), you can ascertain the cost of the vehicle that you can bear the cost of and the credit sum for which you’ll have to qualify.

In addition, you need to think about other costs, such as sales tax, registration fees, and insurance premiums. Taxes and registration fees can increase your out-of-pocket cost by as much as 10 percent or more. Driving a car that’s worth more than your current one will cost extra in insurance. Before getting too far into the buying process, check with your insurance agent or get insurance quotes online so that you understand what you’re getting into.

Focus on Your Needs

Start by asking yourself a few essential inquiries to discover models that exceed expectations in the regions that issue to you.

How many people will you carry?

Most vehicles will suit five individuals, in spite of the fact that the focus raise position is regularly unreasonably awkward for an adult. If you need to carry more people, you should look for a vehicle with a third-row seat. This includes all minivans, a growing number of SUVs, and a few wagons. Depending on the design, these vehicles can carry seven or eight people.

Keep in mind the third-row seats in small and midsized SUVs are cramped and appropriate only for children. An increasingly rare seating configuration is the three-person front bench seat. Found in a handful of sedans and pickups, this is one way to achieve a six-passenger capacity. But their center seat lap belt doesn’t provide adequate protection in a frontal crash.

A vehicle with a third-row seat is a better choice. Many two-door coupes provide seating for four people, but the rear seat is often very tight and uncomfortable, and folding the front seat forward so that you can load groceries or secure a child’s safety seat in the back seat gets old fast.

How much cargo do you carry?

Most car trunks accommodate a reasonable amount of luggage, but sometimes, you’ll want to carry things that won’t fit in a trunk. For carrying more cargo or longer items, make sure the car you’re

considering has rear seatbacks that fold down, enlarging the trunk area.

Certain sedans have a front passenger seat that can fold flat as well, making it easier to carry extra-long items. If you regularly carry large items, such as camping or sports equipment, you could find that a minivan, an SUV, or a wagon is better suited to your needs. Their sizable cargo zones can be extended by collapsing down or expelling the back seats. Keep in mind that carrying passengers in a third-row seat significantly reduces the room for cargo.

A pickup is useful if you often carry dirty, heavy loads. A crew cab, with two sets of full doors and two regular rows of seats, is a popular choice because it can seat up to five people.

If you prefer a smaller car with cargo-carrying ability, consider a hatchback. It often has more interior space than a car with a trunk, and the hatch makes it easier to get large items in and out.

How do you like to drive?

Brisk increasing speed, fresh taking care of, what’s more, responsive guiding is essential in any vehicle. If you’re an enthusiast who wants to feel the road and be one with every part of the driving experience, these attributes will probably be high on your priority list.

Generally, sports autos and numerous roadsters obviously fit the bill, yet some make you forfeit space for conveying travelers and payload. Many buyers are torn at this point: They want a sporty, fun-to-drive car but need the practicality of a sedan or wagon. A number of models combine fun and practicality, but a common trade-off for sportier cars is a stiff, sometimes uncomfortable ride.

Maybe you prefer a softer ride, luxurious seats, plenty of convenience features, and isolation from the outside world. Plenty of luxury vehicles, from family sedans to SUVs, deliver that experience. Perhaps you need only basic transportation—a comfortable, reliable, fuel-efficient commuter.

Though, on paper, a number of models fill this need, it’s still important to do your research. Within a given price range, there are big differences in reliability, fuel economy, comfort, and overall value.

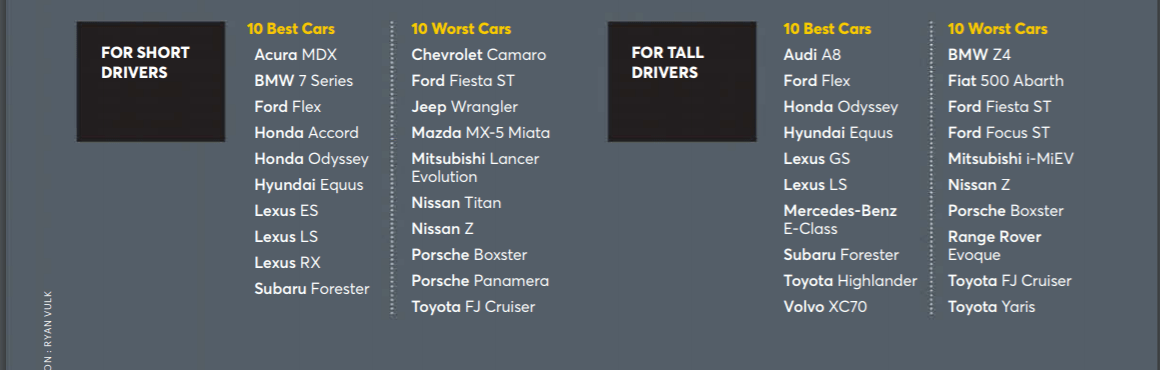

The Tall and Short of It

Before you buy, make sure your next car fits your size

MOST VEHICLES are supposedly designed for a wide range of body types, but many don’t accommodate short or tall drivers very well. To find out which ones are better or worse, we took a look at the scores

of recently tested models that are relevant to late-model used cars and equivalent designs.

We focused on ratings for seat comfort, driving position, access, and all-around visibility. The briefest analyzer on our staff is 5 feet 1 inch; the tallest is 6 feet 4 inches. A couple of vehicles were appraised exceedingly by both tall and short analyzers.

Families with various measured drivers should seriously mull over the Honda Odyssey or the Subaru Forester. Several serve neither tall nor short drivers very well, like the Ford Fiesta ST, Nissan Z, Porsche Boxster, and Toyota FJ Cruiser. Sports cars can be uncomfortable for both groups: Tall people might hit the roof, and short people might not reach the clutch comfortably without compromising the driving position.

Making the Final Cut

When you know your price range and the type of vehicle that interests you, and you’ve used our tools and comparison charts to find the models that meet your requirements, it’s time to narrow the candidates to a few promising models that are worth spending the time to test-drive.

Model reviews.

To get an in-depth perspective on a model, it’s important to read reviews from sources you trust. Good ones can tell you how a vehicle handles, accelerates, and brakes and how comfortable and user-friendly the interior is. They also highlight shortcomings and deficiencies you might overlook. Because different sources have varying points of view, we recommend reading a variety of them.

Keep in mind that most model reviews that appear in publications or on websites are supported by automaker advertising, and they may not want to offend their advertisers. So, although you can get insight into a vehicle’s performance and driving character from those reviews, you will seldom find very much hard-hitting criticism or an in-depth exploration of safety or reliability concerns.

CR road-test reports.

Consumer Reports maintains road-test ratings on groups of competing vehicles in a similar price range and category (such as family sedans, small SUVs, minivans, etc.). This way, once you have decided on the type of vehicle you want, you can easily compare models within a particular class.

You can compare vehicles by arranging test drives of the same class of vehicle one after the other. As you do, take notes on areas of special interest to you, such as seat comfort and driving position, and the presence or absence of features you like, such as heated seats, leather trim, and lots of cargo space.

CR owner-satisfaction data.

Though user reviews provide some helpful information, each year, our subscribers give us detailed feedback on their satisfaction with the vehicles they own. Our owner-satisfaction ratings are unbiased and are based on hundreds of thousands of subscriber reports on the benefits of buying used cars as part of our Annual Auto Survey.

Other sources of reviews.

Many publications and websites regularly review new cars. But keep in mind that they almost always borrow test vehicles from the auto manufacturers’ specially maintained press fleets. Vehicle problems are addressed before the cars are delivered to auto reviewers or they’re taken out of the press fleet. Auto enthusiast publications also focus on a vehicle’s performance attributes, often at the expense of more everyday concerns such as safety, reliability, and fuel economy.

Newspaper auto reviews are more difficult to find, but they’re geared toward the everyday driver. But auto sections are intended to draw advertising from automakers and local dealerships. As a result, such reviews may overlook a car’s shortcomings, and reviewers with limited automotive experience write some.

Most car-buying websites provide reviews of many new vehicles, but many just recycle what they pick up from automakers’ press kits. They don’t review, judge, or test products and services themselves.

If you like the benefits of buying used cars information, please give us feedback.