Recently, there have been Commercial Loan Truerate services. If you’re thinking, “What is it? Why are there so many conversations about that? How can I avail of this service?” Newscutzy gets you.

If existing investors wish to expand their business they will also require capital, however, most investors don’t have enough funds to make it happen.

In order to resolve this issue, Commercial Loan Truerate Services offers a more favorable opportunity for loan service. After reading the key points listed below, you will be able to understand what Commercial Loan Truerate Services is.

What is TrueRate?

TrueRate is a commercial real estate (CRE) advisory firm based with a wealth of experience in capital markets as well as investment sales. They make use of real-time, high-tech data to improve the valuation and underwriting process to help commercial real estate buyers as well as finance.

Commercial loan TrueRate Services is often the option for many small-sized business owners to obtain loans for their businesses.

Chicago Injury Lawyer langdonemison.com – Best Guide

The aim is to increase the quality and quantity of their clients’ transaction results. Over $22.9 billion of CRE financing Del Toro Insurance- The guarantee of being well-insured, and asset sales of more than $250,000, the aim is to change CRE financial markets as well as the results of investment sales by decreasing their clients’ transaction complexity.

What are the Definitions of commercial loan Truerate Services?

It is the technology-enabled lending market that helps lenders and investors. The Commercial Loan Truerate Services gives investors and small businesses a real-time overview of the market for their investment products.

Truerate Services offers a variety of loan products to help you find the right solution for your business. To properly understand and rate services, it is important to know some keywords. These keywords are listed below:

1. What is a Commercial loan?

A commercial mortgage is a debt-based financing arrangement between a company and a financial institution like a bank. This type of loan can only be used for commercial purposes. This type of loan can be financed by a debt-based financing agreement between an investor, and a lender.

2. What does Truerate mean?

It is generally a service that helps you in obtaining an e-commerce loan or provides services for capital market and investment sales CRE (commercial realty).

It is a commercial lending platform that has helped investors obtain billions in commercial financing and loans. It was established in 1999. Many investors and business owners prefer Truerate to obtain loans.

Best tips to Hire a Car Accident Lawyer Near You

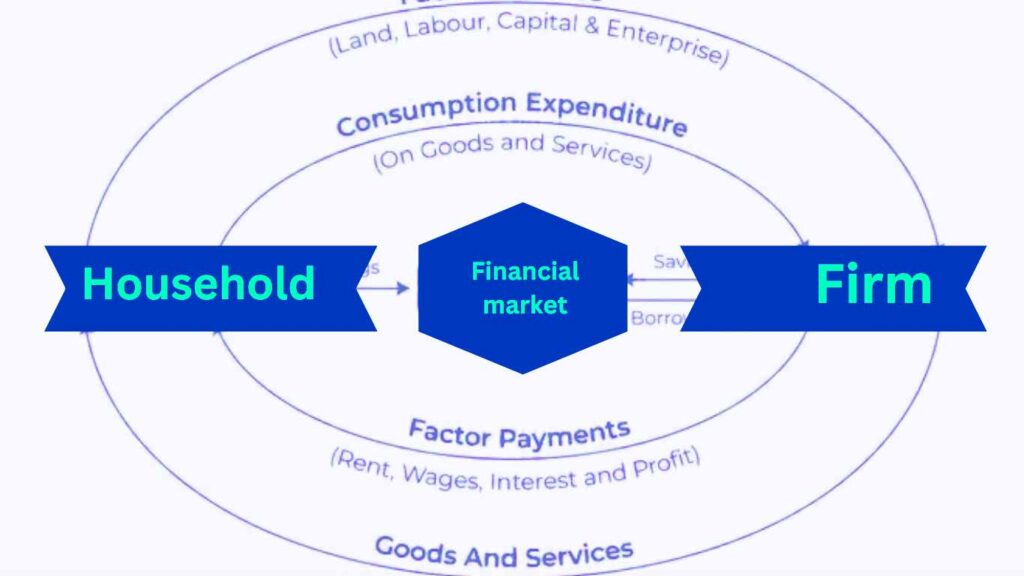

3. What are capital markets?

Capital Markets refer to activities that take funds from one entity and make them available for other entities.

It is a market where long-term debt, stocks, equity, and bonds can be bought and sold. “Long-term” refers to a period of more than one year. The United States Securities and Exchange Commission (SEC), protects the financial markets.

The capital market acts as an engine and a source for capital accumulation. The capital market provides funds to investors, which contributes to economic growth. The circular flow of money is the function of capital markets. A pie chart can help you understand this.

How many Types of Commercial Loan Truerate Services?

There are generally four types of commercial loan services.

- Space for offices: Call centers, offices, and other businesses

- Retail industry

- Multifamily rental

- Industries in the area

Best Tips for Choosing the Best Mesothelioma Lawyer

What are the Requirements for a Commercial Loan?

- These are the most common prerequisites to receiving a commercial loan.

- Credit score (or better):

- A company’s turnover should be high.

- Collateral Evidence

- The firm should have earned a good or large amount of profit in the last financial year.

- Investors and Individuals should be between 21-65 years old.

- Business Plan.

- Every loan applicant must meet the income requirements of the firm.

Why should you choose commercial loans TrueRate service?

Truerate services for commercial loans offer many benefits. Many businesses use these services to fund expansions, new operations, and projects. These are some of the many benefits that such services can provide.

- To avoid any hassles or risks, it is better to use secured services such as the Commercial Loan Truerate services.

- The Commercial Loan Truerate Services have a structure to guide you through the process. This will help you understand how to apply for commercial loans.

Does My Insurance Cover Me When A Tree Falls On My Car?

Know The TrueRate

There are often hidden fees or additional charges when you apply for loans. This is especially true for commercial loans. In some cases, the interest rate may seem low. However, if you add other charges to the equation, the rate will increase a little. This is the TrueRate.

Truerate services for commercial loans will allow you to calculate the true rate of your loan by adding up interest rates and other fees. A truerate service for commercial loans can provide you with the actual interest rate for a loan.

Save You Time

There are many lenders who will lend a loan to commercial customers when you search for them. It can take a lot of time to calculate the true rate for all lenders. Calculating the true rate would take a lot of time.

You will find it difficult to focus and organize your business if you do this. It is possible to spend time looking for business opportunities.

It is a good idea to seek the help of a reputable service in order to be able to focus on your business and save time.

Do You Need Car Insurance (Auto Insurance) To Drive?

Good Idea

You might overlook the best options when you are looking for commercial loans. You might not have enough information about lenders to find the one that offers the lowest interest rates. You would be sure to miss the best choice in such situations.

You will need to be able to compare all lenders in order to get the best loan. True rate services can assist you with this task because they have access to all available lenders who may be interested in financing your business.

Need A Proper Guide

These services are experts in the field of commercial loans. This is why you should hire such a service to finance your business.

They may also be able to help you select the right lender based on your business history, policy, or other factors. You should not only look for the lowest rate when choosing a lender.

It is important to review the terms and conditions of lenders. You can use the service of a professional to help you choose the lender that offers easy loans.

How Commercial Loan Truerate Services Help To INVESTORS?

Commercial loan Truerate services help you in:

- Financial Planning: It offers a range of financial planning services that can help you save money.

- Low-interest Rate: This loan offers low-interest loans that can help save you money.

- It helps companies raise their working capital.

- It helps companies purchase the latest equipment and MACHINES FOR PRODUCTION.

- You will pay no more on your mortgage than you rent each month.

Best tips to Hire a Car Accident Lawyer Near You

Different types of loans Commercial TrueRate Services work with

True rate services can help with any type of commercial loan, while others only offer a limited range of loans. Let’s learn more about the truerate services that can help you with commercial loans.

Commercial Business Loan – A commercial vehicle loan is available for those who need to purchase commercial vehicles, such as trucks, buses, and trailers. You must have good credit and a well-run business. A minimum of two years of experience in the business is required. In some cases, two to three vehicles are a requirement.

Commercial Mortgage Loan – This loan is used to acquire, refinance, or redevelop commercial properties. Apartment complexes and industrial warehouses are all included in this loan. This loan is available for lending by a variety of financial institutions, including banks and commercial lenders.

Commercial Real Estate Loan – This loan is for commercial real estate projects. This loan is usually used to finance commercial properties that will generate income in the future, such as apartments, office spaces, hotels, retail spaces, and so on.

SBA Loan – This loan is for small businesses that are just starting out or have been in business for a while. An SBA loan amount is usually very small because it’s designed to assist small businesses in their primary stage. It is also due to uncertainty about the business’s success. Lenders often offer small amounts to protect the money.

Equipment Loan – An equipment loan is a loan to finance any machine or tool used in a business. This loan can be used to repair, replace, or purchase one or more tools or equipment. This loan can finance any equipment required to improve a company’s efficiency.

Lines of Credit – A business loan with a fixed amount of money from the lender is a line of credit. You can take money from the lender when you need it and repay it as soon as possible. The credit line will reset once you have paid it back. You can choose any amount again.

How Do Charges a TrueRate Service Calculate?

Commercial loan truerate services have additional costs. Before you make a decision, it is important to calculate the other fees associated with these loans. Truerate services do that for you.

Processing Fee

This is the total cost of the entire process. This charge is not included in the interest rate. This is a large-scale deal that involves a lot of money. There are many costs associated with security and other issues. The cost of the entire process will be charged to you.

Annual Fee

For maintaining your loan account, some lenders charge an annual fee. This is most common in banks. This fee is not charged by other financial institutions.

Each lender will determine the annual fee. Some lenders charge 500 USD, while others may charge 2000 USD each year. They have to use their resources to maintain and monitor documents and processes relating to the loan you took.

Legal fees

Unsecured loans do not require legal attachments. In these cases, there is no legal fee. However, legal attachments will be required for secured loans. There are legal fees and fees that come with secured loans.

The amount of the loan and its complexity will determine the legal fees. This fee typically ranges between 2000 and 5000 USD. If the loan is complex, the amount could be higher.

Credit insurance fees

A credit insurer is required for commercial loans. Credit insurers offer some services. These facilities require you to pay a fee. This is known as a credit insurance charge.

A credit insurance cost is usually not excessive. Credit insurance fees are usually between 1 and 1.5% of the total amount. It all depends on which credit insurer you choose or what lender you are using.

Penalty charges

If the borrower does not follow all conditions of the transaction, a penalty charge will be applied. Penalty charges are usually triggered by failure to pay the EMIs. You’ll also find other common causes.

The penalty charge is not directly calculated at the time you calculate the truerate. The penalty charge is something you should be aware of. Before you apply for a loan, make sure to read the terms.

Commercial loans can also come with additional costs such as a part-repayment fee, loan rescheduling charges, foreclosure charges and EMI bouncing fees.

How do you get started with Commercial Loan Truerate services?

- ID proof

- The applicants will be issued security cards

- Passport

- Both partners and owners can have a driving license

- Proof that is your address

- Proof that you are a business

- To prove their address, applicants will need to produce telephone bills and electricity bills.

Commercial Loan Truerate Services requests balance sheets, bank statements, and partnership agreements just like any other company.

After that, the process is seamless and the firm provides assistance until you’re ready to go.

Is the rate of commercial loans fixed?

Commercial property loan rates are either fixed or variable depending on your qualifications. They will decrease as your principal increases. These SBA commercial loan rates on real estate could be anywhere from 5.5% to 11.25%. This financing typically has an LTV ratio of around 80%.

What is considered a good credit score to get a commercial loan?

To be eligible for a commercial real estate loan, most lenders require that borrowers have a credit score of at least 660. Commercial real estate loans may be either term loans, SBA loans, or lines of credit.

What is the cost of truerate services?

It all depends on which service you choose. Some services require a fixed amount, while others ask for a percentage. You’ll also find services that offer both. You can choose one.

This is important to remember when comparing options.

What is the maximum amount you can pay off a commercial loan?

Commercial loans are typically longer than residential loans. The amortization period is usually longer than the loan term. For example, a lender might approve a commercial loan with a term of seven years and an amortization period that is 30 years.

Are commercial loans easier to obtain?

Private companies usually make these loans and have higher down payments. The loan application process is much simpler than traditional mortgages and the loan can be obtained faster.

What are the two types of commercial loans available?

A secured term loan usually has a lower interest rate that an unsecured loan. This loan type can be classified as a short-term loan depending on the repayment term. Medium-term loan: Repayment term between 1 and 3 years.

Which statement applies to an adjustable-rate mortgage?

Which one of these statements is true about adjustable rate mortgages (ARMs)? You can adjust the ARM’s rate periodically. Lenders are less likely to be subject to interest rate risk with ARMs.

What is the average time it takes to repay a commercial mortgage?

While other business loans can be repaid in a matter of weeks or years, many commercial mortgages allow you to pay off your loan for up to 30 years.

What is a 504 Loan?

SBA 504 loan. SBA 504 loans can also be backed by the SBA. SBA 504 loans are funded partly by a lender, and partially by Certified Development Companies. The loan interest rates will remain low and the certification of development companies (CDCs) will continue to be long.

Last Word

These are all the details you need about “commercial loan truerate services”. These services are a great option for commercial loan needs. These services can provide many benefits in return for a few dollars. You can be confident that your Commercial Loan TrueRate Service will last a while.

Commercial loans can be complex and have many conditions and restrictions. Processing everything by yourself can prove difficult. This is why it is recommended that you seek out such services. Now that you have a better understanding of how these services can benefit you, it’s time to make your decision.

Dear friends, We are grateful that you have visited USFinancingLoan.com. This article will cover a topic that is important to Commercial Loan Truerate Services. Capital (money) is essential for any business to start.